Market Declines, Recession, & Inflation

Source: S&P 500 and Bloomberg Bond Aggregate Index; FactSet, Archer Bay Capital LLC

Experiencing a market decline is never a pleasant experience. Sometimes it feels like there is no place to hide. In the chart above, the one-year performance of the broad US bond market index and the S&P 500 are compared. Stocks have had a painful ride over the last two and half months, but bonds don’t look great over the past year either.

How long do we think this is going to last?

We examined past market declines for insight. Prior to this current decline, we have identified 16 instances when the stock market declined at least -10% over the past 72 years.

Ten of those 16 declines happened during recessions. The median time to recovery from those declines was 10 ½ months.

Six of those declines were not during recessions. The median time to recovery from those declines was 4 ½ months.

Is the economy going into recession?

Obviously, the Covid pandemic has caused a lot of economic damage around the world. Most governments responded with various stimulus programs – from distributing cash, providing loans, and increasing government spending. Some governments, like the US government, did all three.

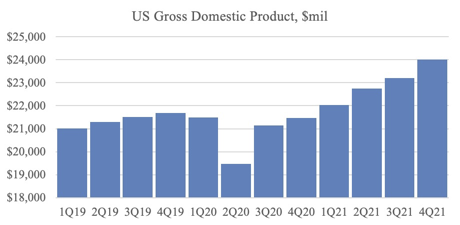

Technically a recession is when the economy shrinks for two quarters in a row. Here is a current snapshot of the size of the US GDP for the past three years.

Source: US Bureau Economic Analysis, Archer Bay Capital LLC

The economy has recovered and now well exceeds the size of the economy before the pandemic. Growth is strong – there would need to be a significant reversal to become a recession. But the recovery has created higher inflation that needs to be addressed.

Source: US Bureau Economic Analysis, FactSet, Archer Bay Capital LLC

The US has had low inflation for more than thirty years, so this spike is a shock. The most recent report in February of 7.9% inflation is the highest it has been since the early 1980s. Inflation peaked at 15% back then. Paul Volker, then the Chairman of the Federal Reserve, raised interest rates so much that it caused the 1982 recession. A five-year bull market followed that recession.

Now, it is going to be a balancing act by the Federal Reserve to raise interest rates enough to bring inflation down but not raise rates so much as to halt economic growth.

Interest rates have been low for so long that we believe a moderate increase is a good thing. Bond holders may earn a real return again. And if higher rates lower inflation by slowing demand for goods, perhaps that will give businesses time to fix the supply chain problems that have occurred since the pandemic began.

Overall corporate profits continue to grow which makes us comfortable with our current equity positions. It is not the best time to hold just any stock. The most vulnerable stocks currently are the companies that are trading at high valuations or that earn low, or no, profits.

Collectively, the companies of the S&P 500 are growing their profits and the dividend yield has been steady at 1.5 percent. The other funds we own, the S&P mid-size companies index and S&P small companies index, are also growing earnings and paying a steady dividend.

Source: Refinitiv, Archer Bay Capital LLC

But regardless of the data, it still feels awful when portfolio values are down. During these times, it is important to keep in mind that the median market return following the 16 market declines was 78%. The minimum recovery was 34% (in 1973) and the maximum was 302% (in 1998).

Please let us know if you would like to discuss in greater detail -- we are always happy to share more in-depth research.