Is the Magnificent Seven really the Magnificent One?

Some of the best performing technology stocks of 2023 have been labeled the Magnificent Seven. They are Alphabet (the parent company of Google), Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. But a deeper examination of the total return of these stocks makes us question just how magnificent they are.

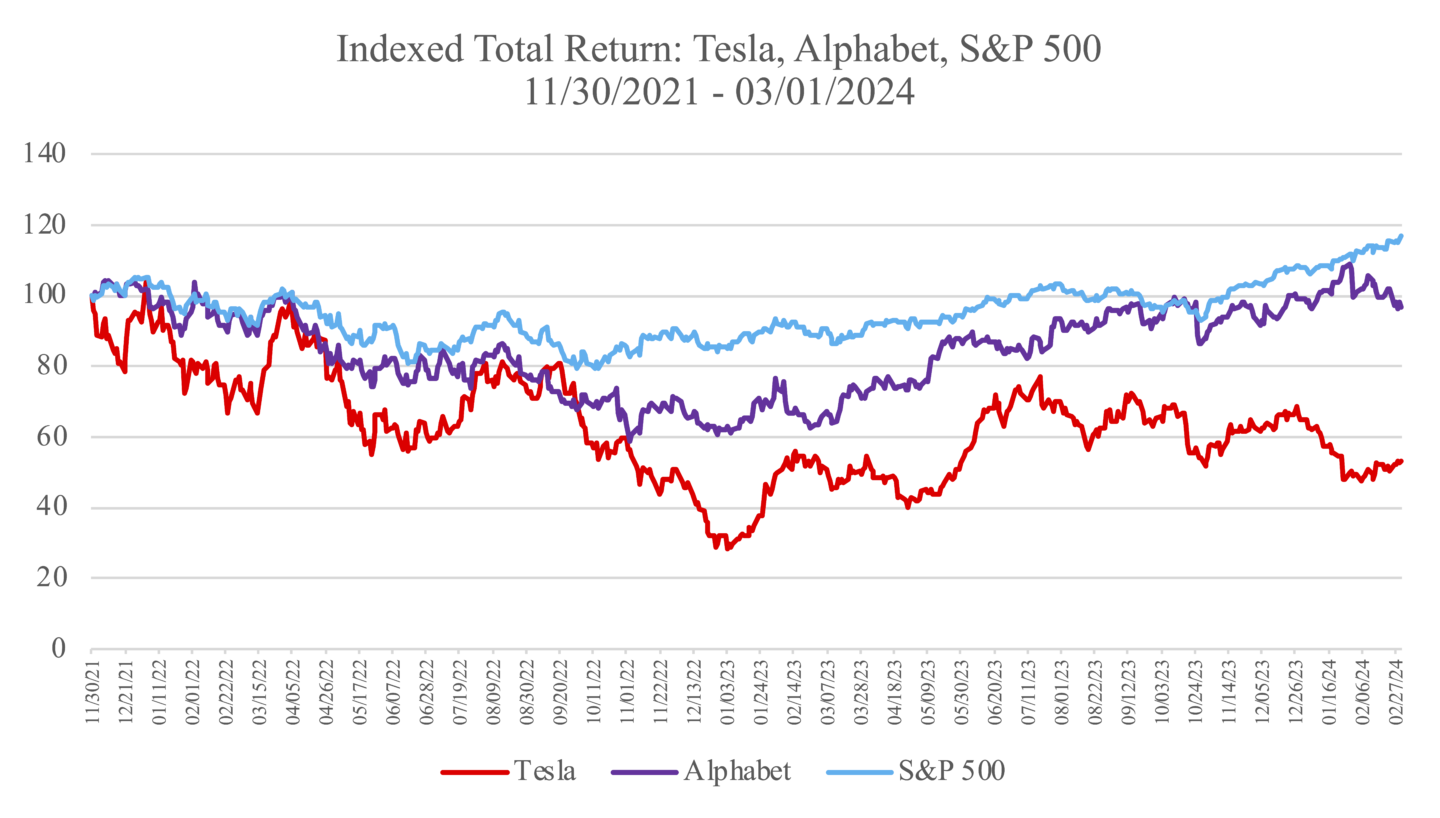

Two of the seven, Tesla and Alphabet (the parent company of Google), are still trading below their prior peaks. They have yet to fully recover from their declines in 2022. Tesla has been the worst performer of the seven, after having fallen more than 70% from November 2021 to the end of 2022. Despite its bounce in 2023, the stock is still down 41% from its prior peak.

Source: FactSet Research Systems, Archer Bay Capital LLC

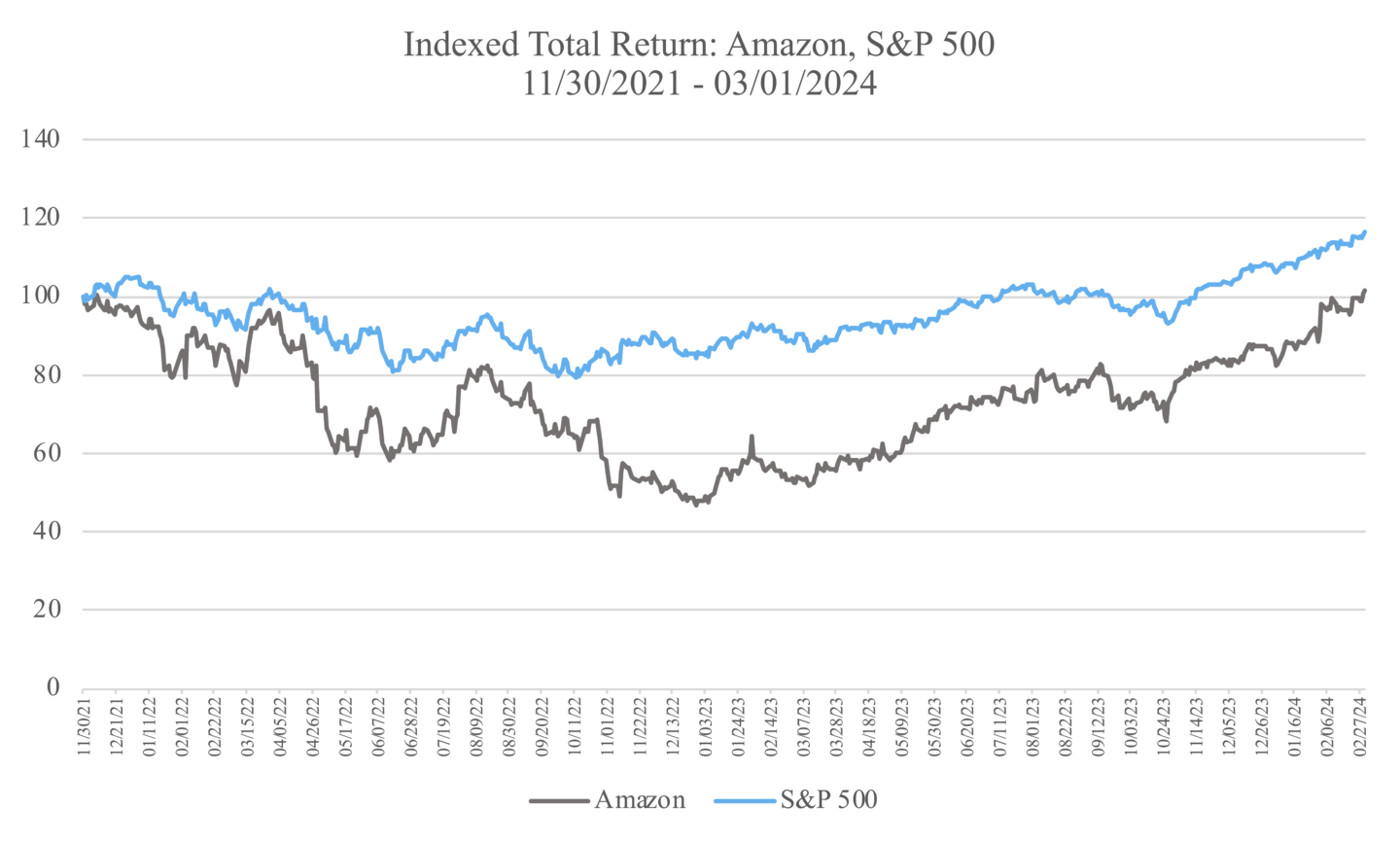

Amazon stock had experienced a 53% decline from its peak to rebound to just 2% above where it traded in November 2021.

Source: FactSet Research; Archer Bay Capital LLC

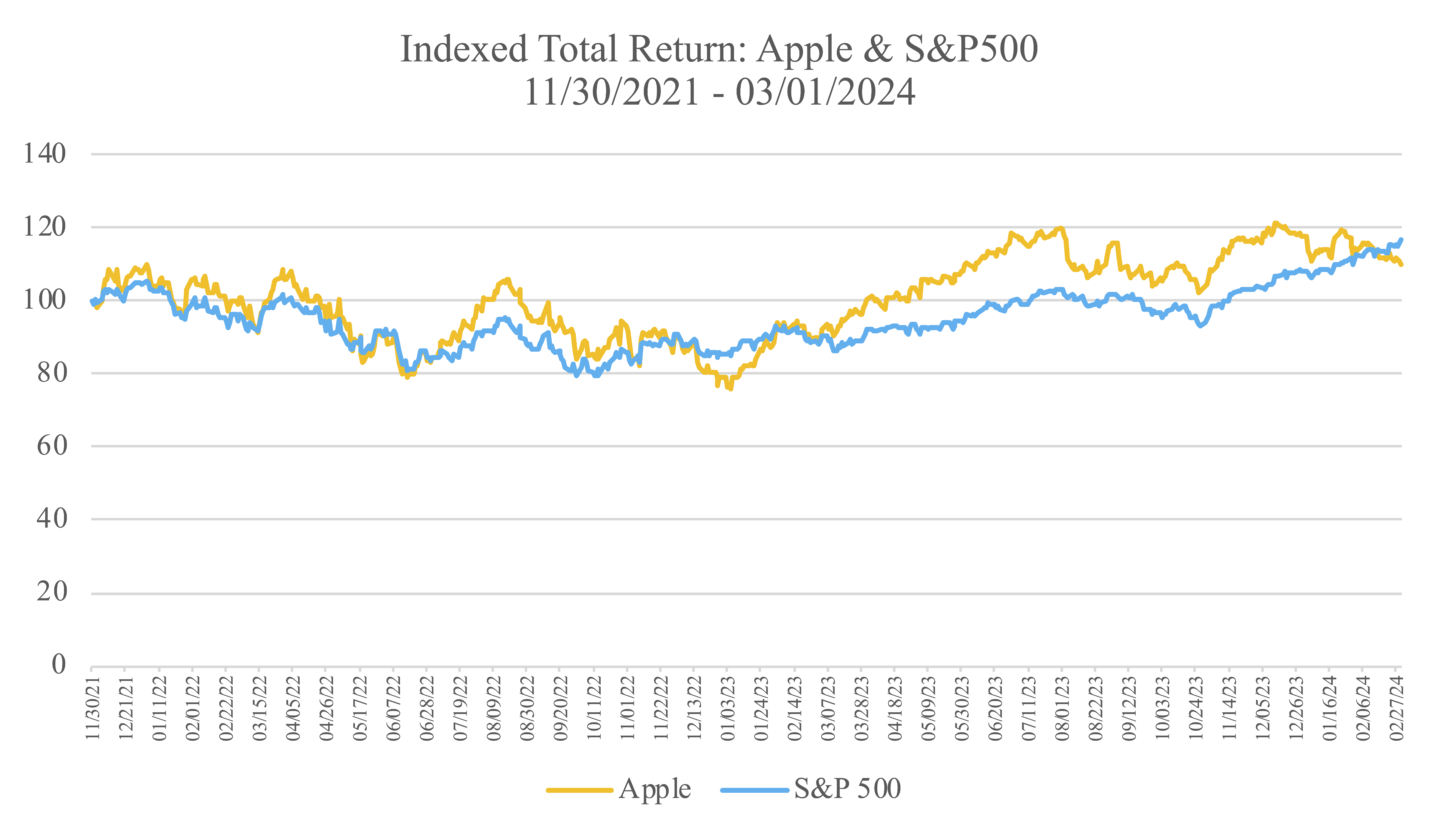

Apple has had a respectable performance since November 2021, having appreciated by 10% since then. But that is less than the return of the S&P 500 over the same time period.

Source: FactSet Research Systems, Archer Bay Capital LLC

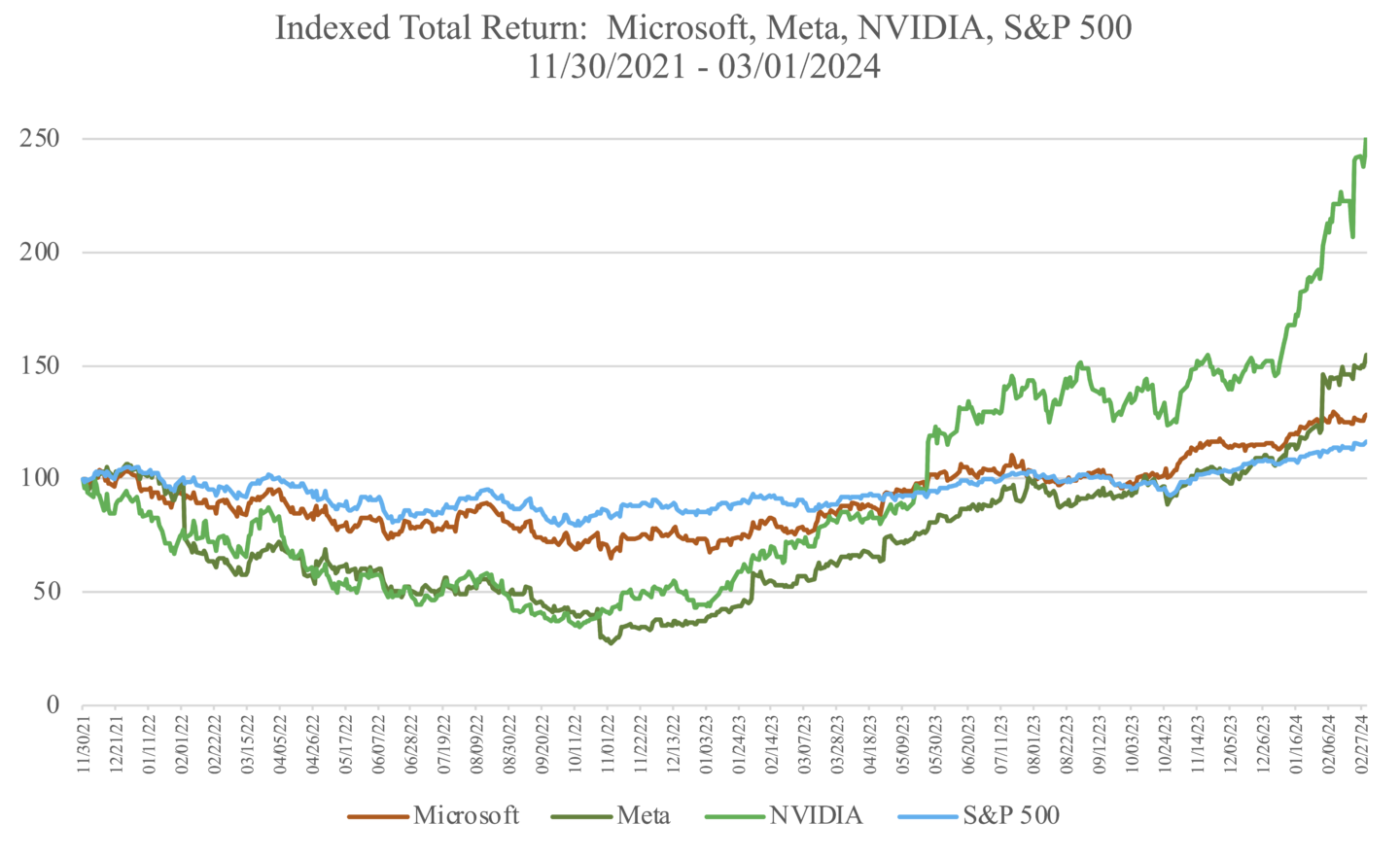

The final three, Meta, Microsoft, and NVIDIA, have had an amazing run, but NVIDIA is truly the standout.

Source: Fidelity Investments; Archer Bay Capital LLC

Interestingly, Meta only recently surged ahead of Microsoft to become the second-best performer after NVIDIA, when Meta reported better-than-expected earnings results for the fourth quarter of 2023.

These seven stocks did have strong returns in 2023 and helped the broader S&P 500 index achieve outstanding performance last year. But those seven stocks all underperformed the S&P 500 in 2022.

Wall Street and the financial press have a short memory. The euphoria of 2023 masks the heartbreak of 2022. November 2021 was the high point for many technology stocks and many have not fully recovered. The S&P 500 index itself has just recently surpassed its prior high from December 2021.

The pain of high inflation and rising interest rates in 2022 continues to linger today in many economic sectors and in the bond market. As always, we look to corporate earnings for insight into the current market.

Source: LSEG I/B/E/S, Archer Bay Capital LLC

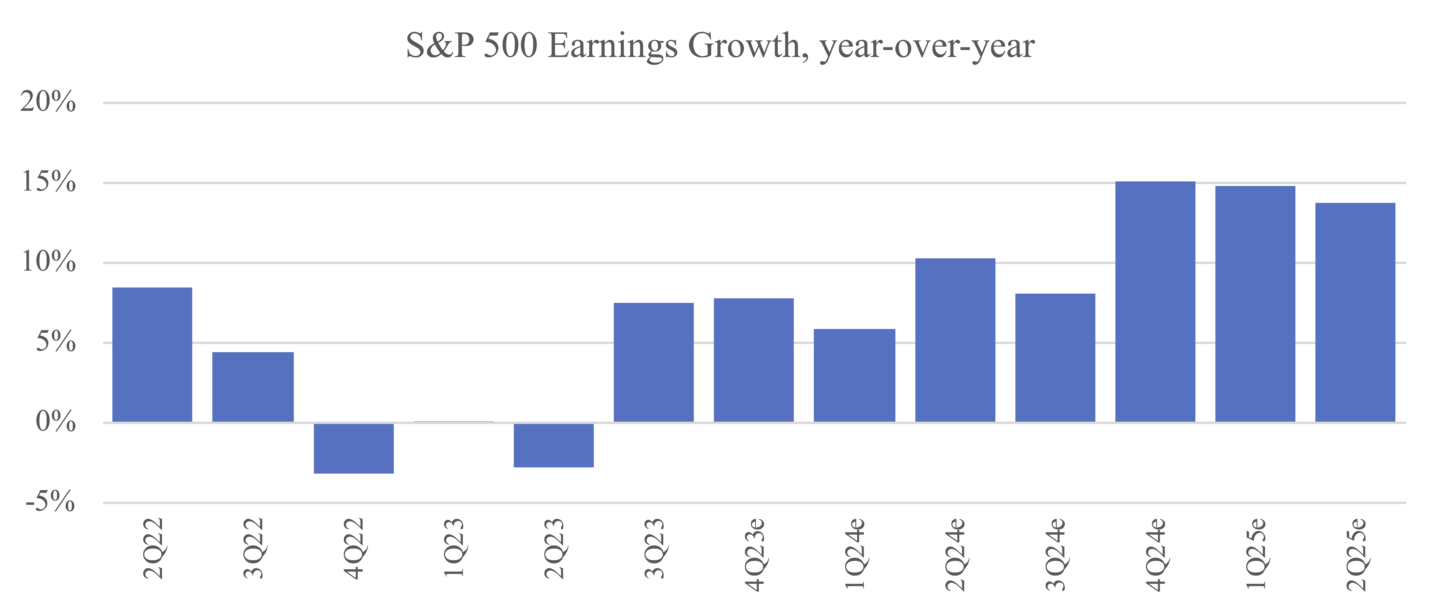

Based on the latest earnings forecasts for this year, Wall Street analysts are currently expecting almost 10% earnings growth for the S&P 500 companies for 2024.

Not all segments of the economy are thriving, with real estate being one of the most obviously stressed. But if unemployment stays low, and if the Federal Reserve does start cutting rates, we expect that it will be an economic tailwind for profits across all sectors to support earnings growth and subsequently, continued positive returns.