Login

Not So Merry Stock Market Performance in 2018

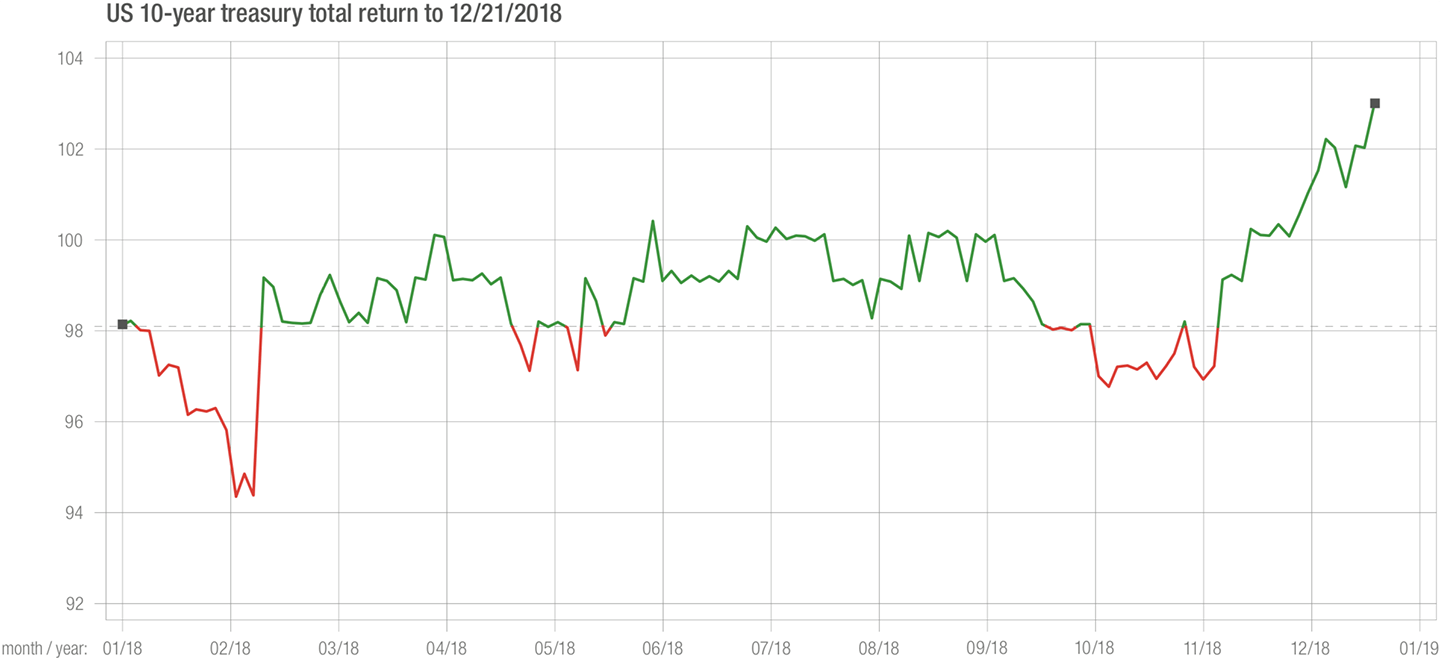

It has been a very ugly stock market to close the year, with the total return from the start of the year through Friday’s close of the market down 5.9 percent. But there is joy in the Treasury bond market with the 10-year Treasury bond returning a positive 4.5 percent.

Source: FactSet, Archer Bay Capital

Source: FactSet, Archer Bay Capital

What is being reported about the stock market is the movement of prices since the peak on October 3rd. It doesn’t include dividends that have been paid, which adds to returns. Even though the year-to-date returns aren’t as dire as the price movements from the peak, it obviously isn’t a good year whenever returns are negative. It turns out this may actually be the worst December for stocks in 10 years.

Stock market performance and investor sentiment

It is unusual to have so many big down days in a row — especially at the end of the year — and the stock market decline may be a signal of a recession coming soon. Investors are particularly uneasy about the Federal Reserve’s plan to continue to raise overnight lending rates next year as they announced on Wednesday.

The Federal Reserve acts as a big clearinghouse for banks. When banks settle their accounts each day, there is frequently an imbalance between available cash supply and cash demands. Rather than sell assets to balance the short-term need, banks can borrow from the Federal Reserve, or from other banks, to even out the daily fluctuations. It is similar to companies using a letter of credit when cash flow is lumpy. When the Fed raises rates as they did on Wednesday, it applies to the overnight lending rates to banks, not to bonds sold in the market.

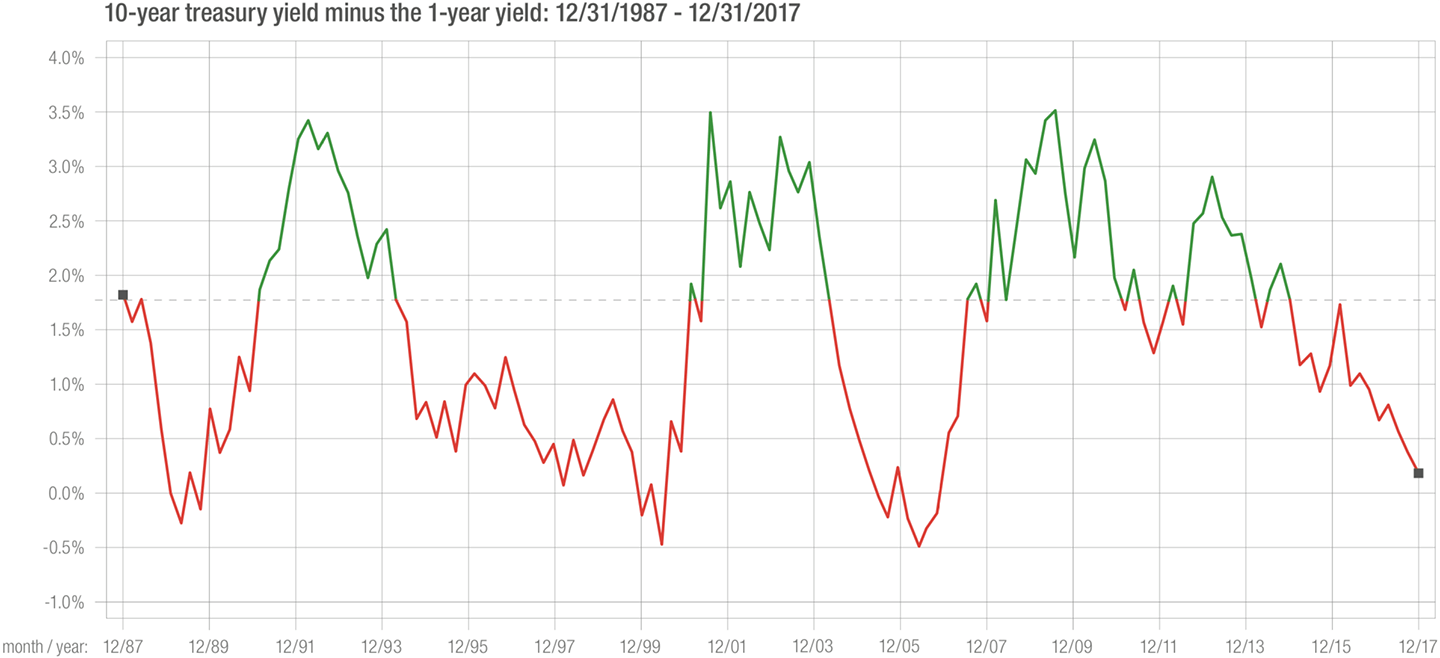

Investors are wary because rising rates are a signal for more expensive lending across the bond market, which can tighten credit availability and slow down the economy. It’s not just the stock market that is nervous, but we see it in the bond market too. The difference in yield across different bond maturities is narrowing which has been a recession signal in the past. This difference in yields between maturities is referred to as the yield spread.

The narrowing of the spread has become particularly pronounced this month. The chart below shows the variation in spread over the past thirty years. Historically, when the line falls below zero, a recessions has followed. The yield spread hasn’t become negative yet but it’s getting close.

Source: FactSet, Archer Bay Capital

Economic indicators and corporate earnings forecasts

In addition to the market behavior, we have also reviewed the economic indicators and the corporate earnings forecasts for 2019. The US indicators are still strong, with high employment and rising wages and moderate inflation. But outside of the US, Europe and Asia are slowing down. All of the uncertainty caused by a variety of unknowns, such as the trade wars, the status of Brexit in the UK, economic slowdown in China, possible recession in Japan and Germany, is creating fear in the market.

The international data is weak and the US data is strong. Will the global slowdown cause the US to slow or will the US strength pick up the global economy as it has so many times in the past? The truth is that we won’t have better visibility until companies start to report their fourth-quarter earnings and provide their outlook for 2019 in January.

Due to the high level of uncertainty and the near-zero yield spread in the bond market, we are nervous about the direction of the economy. We don’t believe that stocks should be sold at this point after the steep fall since the start of October, and we do think that dollar cost averaging into stocks, as in 401k plan contributions, makes sense because of the long-term nature of those accounts.

Strong results, weak stock market

However, we aren’t moving our asset allocation to increase equities and we are happy to hold higher cash amounts. We need to have more visibility on the direction of the data which we won’t have until January earnings reports. 2018 had strong results but a weak stock market and the bond market doesn’t believe the strength will continue.

At Archer Bay Capital, we believe that it’s important to review what we know about the stock market before making assumptions. We take a personalized approach to delivering exceptional financial guidance to investors like you to ensure financial health for the long term. Contact us to learn more about stock market performance in 2018 and what it means for your portfolio, or to set up a consultation today.