Brief, and Surprising, Review of the Market

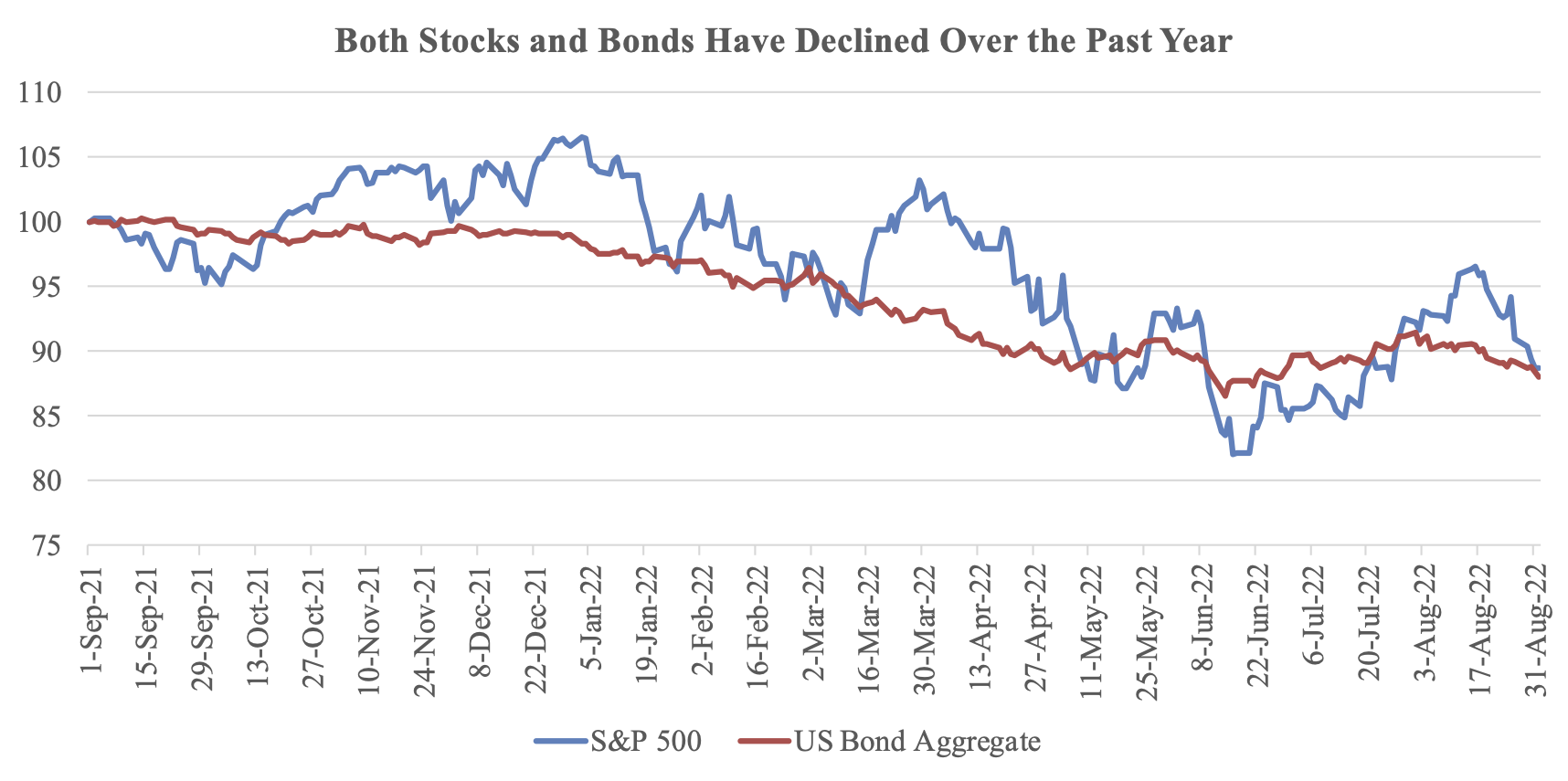

During stock market declines, bonds usually hold their value, but this past year has been different. Both have been under pressure as higher inflation impacts bonds and stocks, but in different ways.

Bond investors want higher bond yields when inflation is high and investors don’t want the low yielding bonds issued over the past few years. Therefore, bond prices are down.

Stock investors are worried about the Federal Reserve raising rates too high and sending the economy into recession. So far, corporate profits have not declined as feared. Stock prices are down even though earnings have been better than expected. We anticipate that stock prices will align with those stronger profits once inflation is better under control, just as they always have historically.

Source: FactSet Research, Archer Bay Capital LLC; Performance above is indexed

High inflation and relatively low bond yields have resulted a 12% decline of the bond market over the past twelve months, through the end of August. This is in line with the 12% decline in the stock market during that same time.

The fear of recession has been a drag on both markets, and with inflation running at 8%, even cash is losing its spending value.

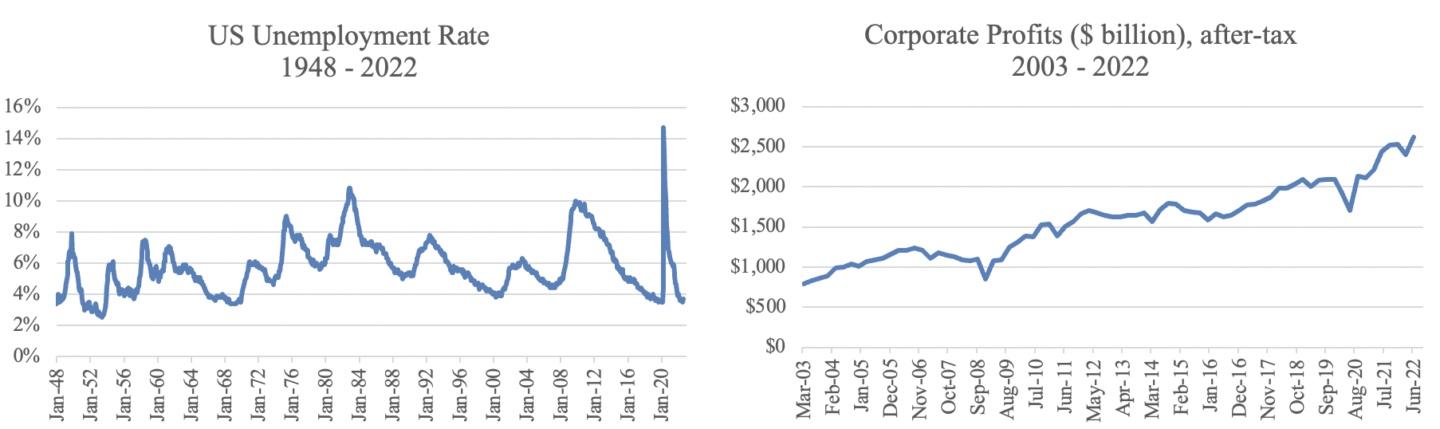

And yet, unemployment is low and corporate profits are strong.

Source: FactSet Research Systems; Archer Bay Capital LLC

During periods of uncertainty and conflicting data, we want to analyze the information in-depth and rely on the numbers to guide our investment strategy. It helps to remove emotion from decision-making.

Deep Dive into Corporate Profits

It is surprising that corporate profits are hitting all-time highs but no one is talking about it.

We can all think of companies and industries that are not doing well. But when we drill down into the sales and profits (aka, revenue and earnings) of the eleven economic sectors of the S&P 500 in aggregate, overall they are quite healthy.

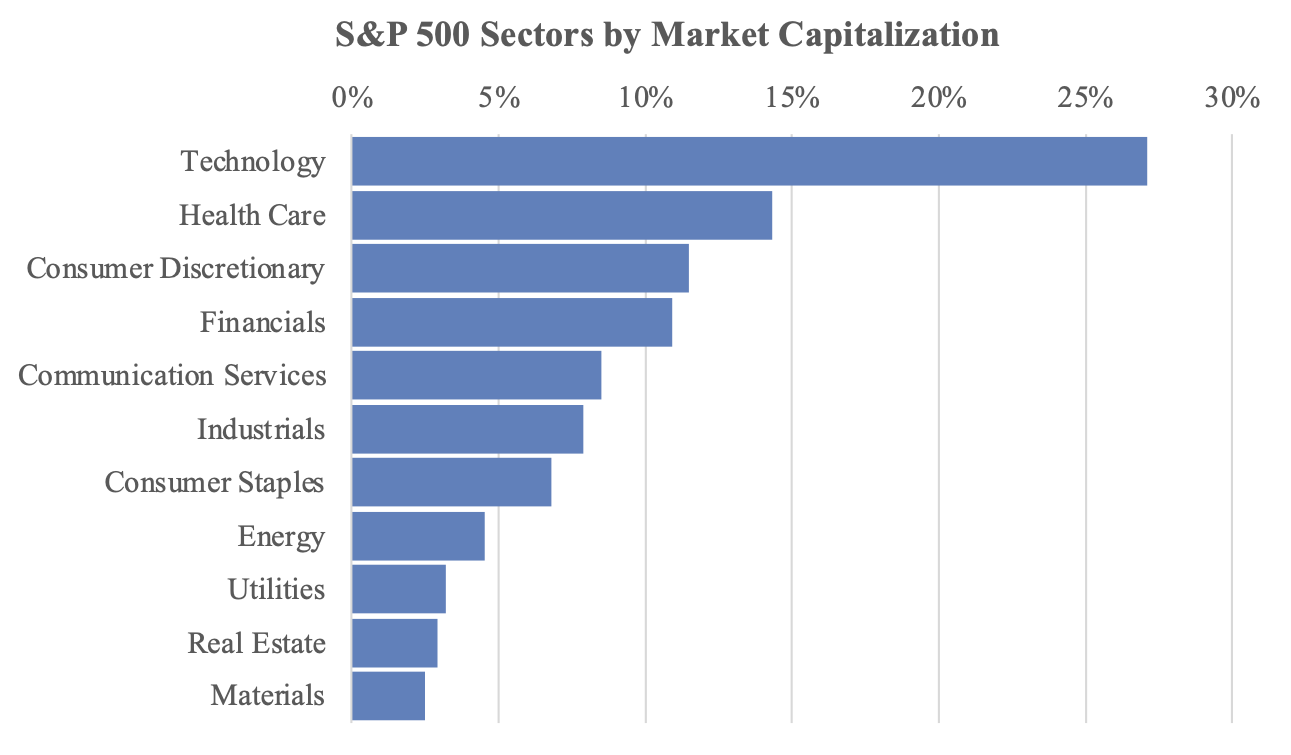

The S&P 500 Index represents roughly 75% of the overall value of the US stock market, so we view it as a reasonable proxy for the large corporate business environment. First, let’s identify the eleven sectors that make up the S&P 500 in terms of size.

Source: Refinitiv; Archer Bay Capital LLC

The largest sectors will obviously have an outsized impact on the earnings of the S&P 500 as a whole.

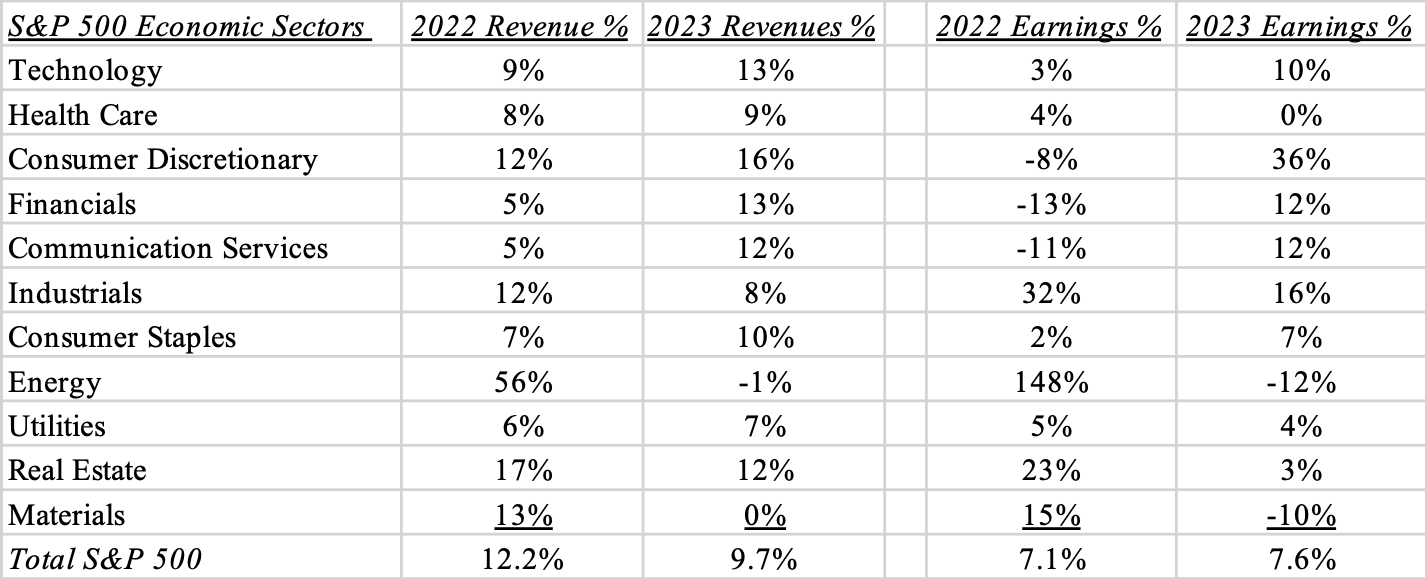

When we dig deeper to look at the specific forecasted revenue and earnings growth of each sector, we do see that they are being impacted differently.

Source: Revenue and Earnings are Wall Street Consensus Forecasts - Refinitiv; Archer Bay Capital LLC

Whenever revenue growth is higher than earnings growth means that profit margins are taking a hit. Companies can’t pass along the full impact the cost increases to customers.

Companies are absorbing some of the inflation burden, which may explain why record-high earnings don’t feel as good as it should.

Consumer Confidence is Down

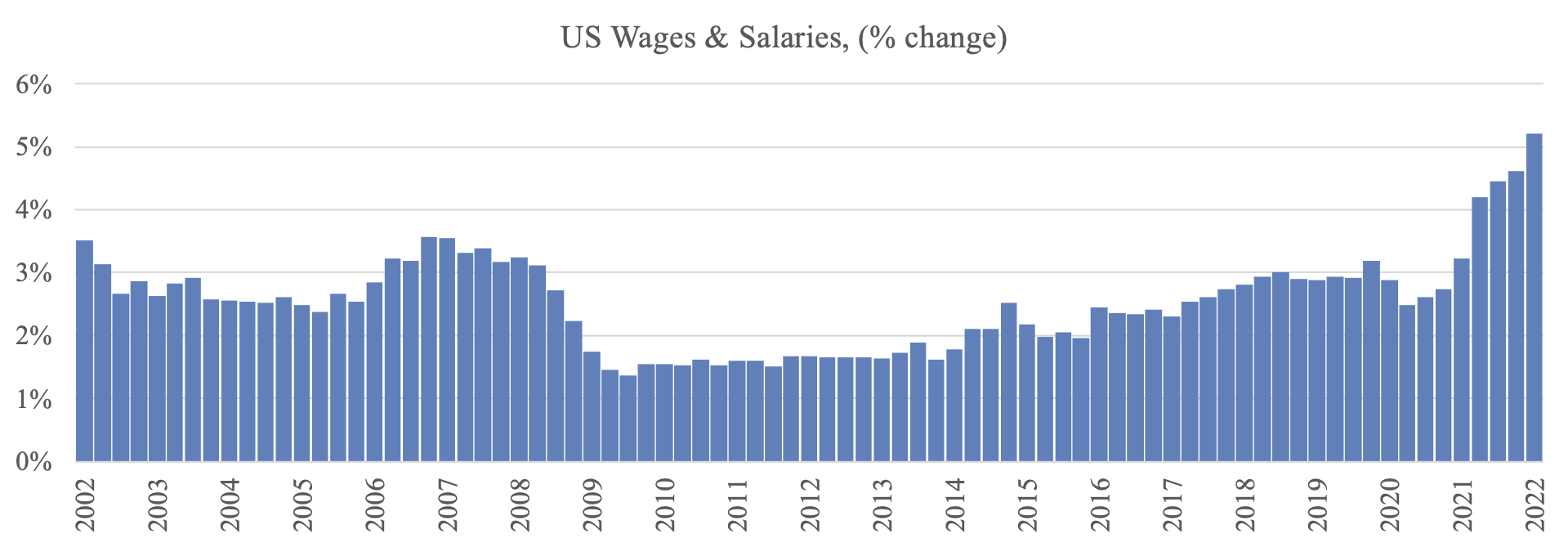

On the consumer side, wages and salaries have also been growing to record highs. But compensation increases over 5 percent doesn’t feel great when inflation is still at 8 percent.

Source: FactSet Research Systems; US Bureau of Labor Statistics; Archer Bay Capital LLC

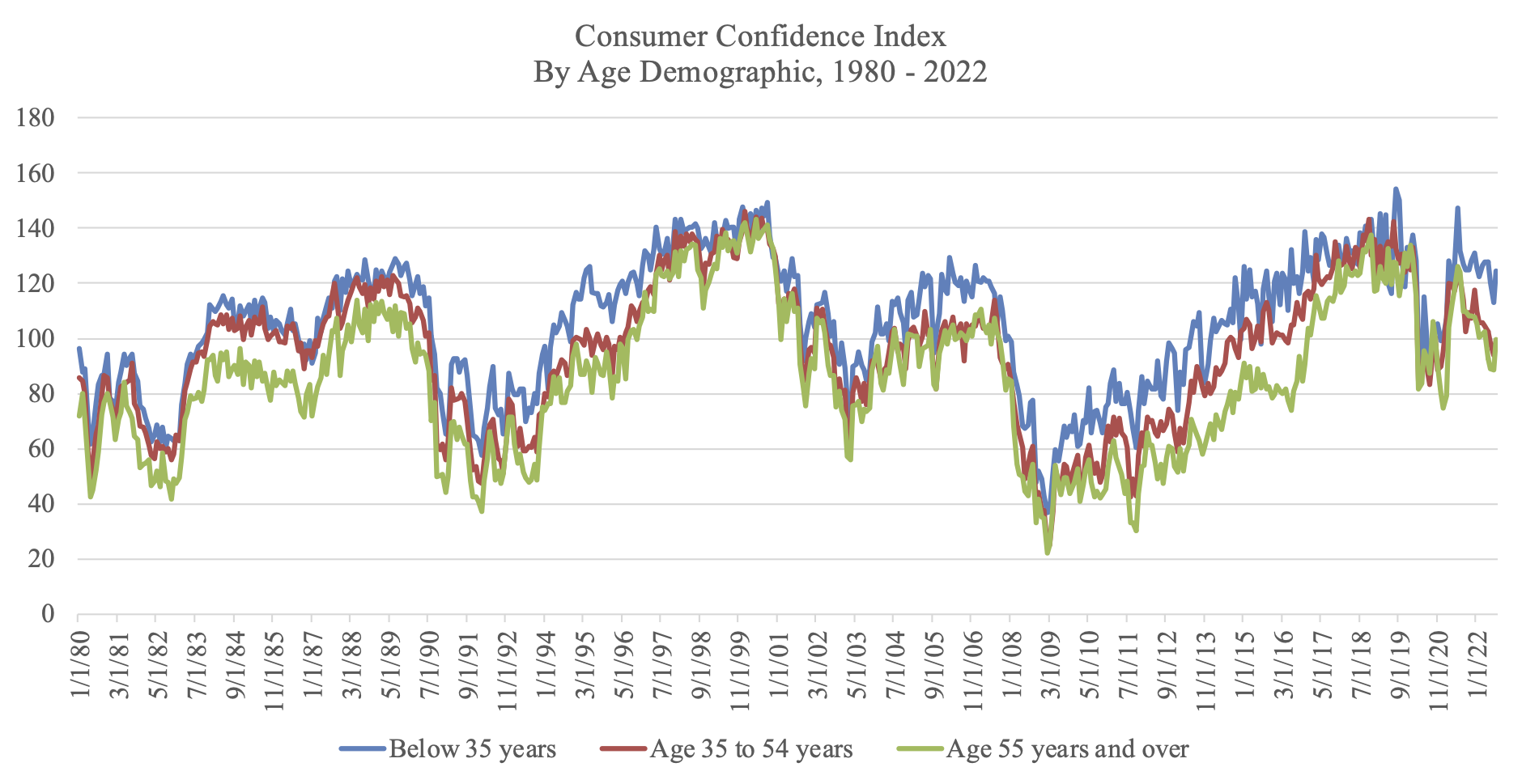

Subsequently, Consumer Confidence has declined over the past year.

As is frequently the case, there is a difference in confidence by age, with older people more negative in their outlook than younger people. While younger people are still largely optimistic (index rating over 100), older people are showing much more pessimism (index rating below 100).

Source: FactSet Research Systems; Archer Bay Capital LLC

There are probably many reasons for the difference, but it is apparent from the chart that the gap is not unusual.

Summary

Our conclusion from the data is that most corporations are doing a decent job managing through a difficult environment. Even though their profit margins are under pressure, sales growth has been keeping the absolute numbers up. Near term stock prices are unpredictable, but over time, stock prices are highly correlated with corporate earnings. With profits at record levels, we are watching for when the stock prices will follow.

Please let us know if you would like to discuss in greater detail -- we are always happy to share more in-depth research.

Terri

At Archer Bay Capital, we help clients better understand the markets and the economy so we can make better financial decisions together. Contact us to discuss stocks, bonds, and our forecast for economic growth, or to schedule a consultation today