Login

Inflation Eats Away at Your Spending Power

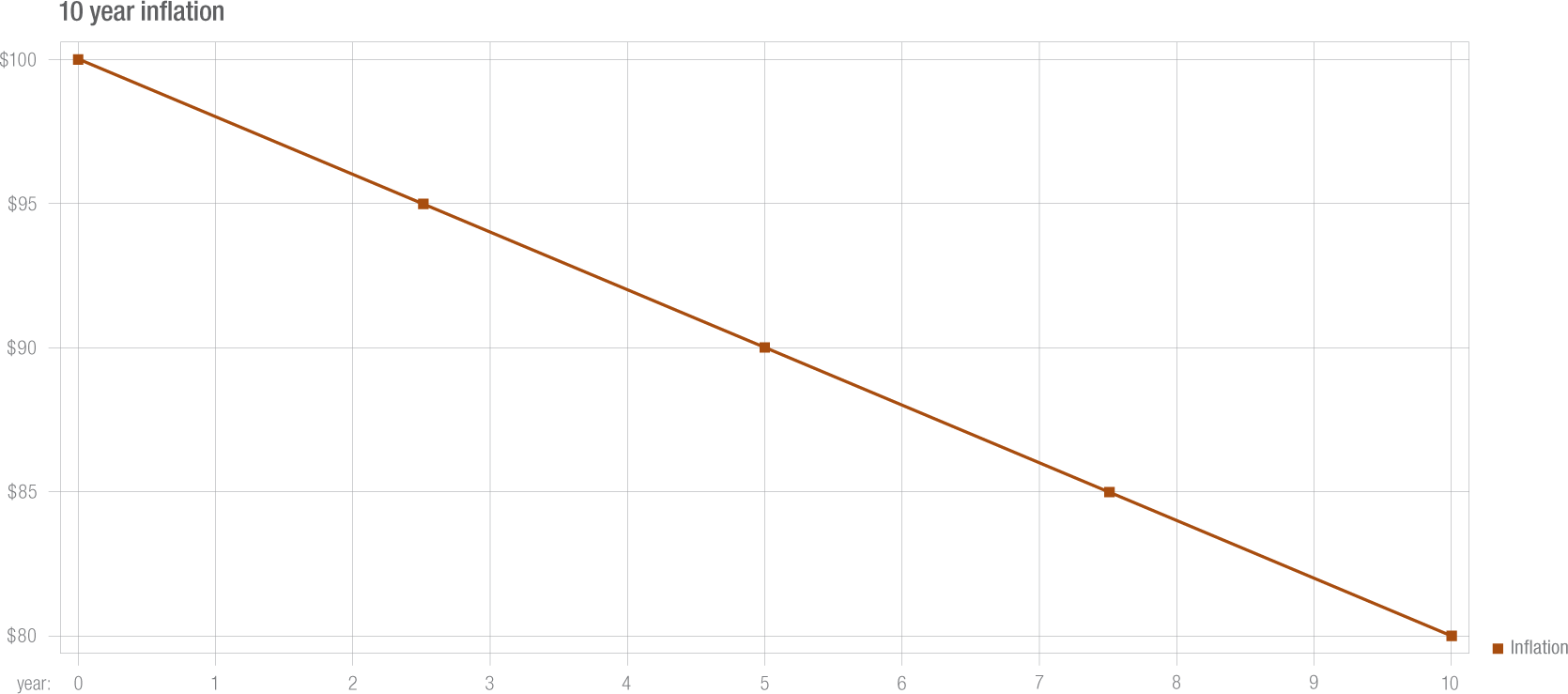

Inflation eats away at your spending power. Every year prices increase for your living expenses (i.e. food, housing, cars, clothing, insurance, etc) and if your income doesn't keep up, your standard of living slips behind. In the US, we use the Consumer Price Index (CPI) as the broad measure for inflation and the current rate is about 2 percent. A two percent inflation rate over ten years turns $100 of spending power to $80. This is the risk of sitting on too much cash. For every investor, the minimum return goal for your portfolio needs to be higher than the inflation rate.

Inflation Influences Bond Yields

The least risky way to stay ahead of inflation is by buying bonds, specifically US Treasury bonds. The US Treasury bond is a common anchor point for the overall bond market because it is considered the lowest risk bond and it is a huge market with maturities ranging from a week to thirty years.

If your job isn't related to finance, you may not know that the Treasury bond market is the US government debt. It is how the government finances its debt, year after year. You can own it and the government pays you interest for lending it money.

Bond investors will look at the inflation rate and decide what bond yield they are willing to accept, such that they don't lose spending power over the maturity term of the bond. And investors usually want a bit more than the inflation rate to compensate for risk that inflation may rise unexpectedly. And they want a bit more on top of that if the company or government issuing the bond is considered more risky. The number one goal of the bond investor is to get their principal back when the bond matures. The second goal is to beat inflation.

Currently US 10 year Treasury bond yields are about 0.75 percent over the inflation rate; the current yield is 2.75 percent. Historically the average range has mostly been between one and two percent over inflation, with a few periods outside of that range on either end. We are below the normal low end of the range. Our takeaway from this is that the bond market is not too concerned about the inflation rate increasing because otherwise the yield spread over inflation would be two percent or higher.

Low inflation is good for the bond investor, but 2.75 percent on a ten-year bond is tough to live on.