Roundtrip for the Market?

Source: FactSet, Archer Bay Capital LLC

Roundtrip from a year ago

Given the severity of the economic shut down and the 30% drop in the S&P 500 from February to March, it is surprising that the S&P 500 Index is above where it was a year ago.

We know that the stock market is always looking ahead…so what is the market seeing that the average person isn’t?

Economists' forecasts are not "V" shaped

The average economic growth forecast from Wall Street is for US GDP to decline -4.8% this year and grow +3.8% in 2021. That does not get us back to where the economy was in 2019. We don’t get back until 2022, which is definitely not a V-shaped recovery.

The main reason has to do with the unemployment rate. GDP is mostly a measure of consumer spending. Since consumers spend less when they don’t have a job, consumer spending should be lower until the unemployment rate declines.

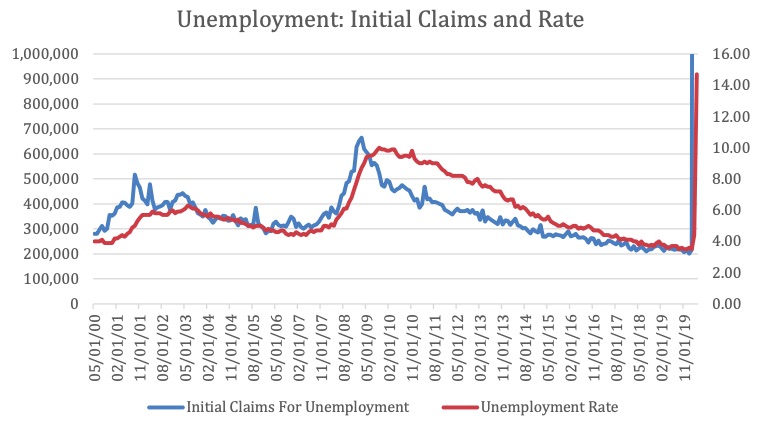

Source: US Bureau of Labor Statistics, FactSet, Archer Bay Capital LLC

The chart above includes two recessionary periods, 2001-2002 and 2008-2009. The initial claims peaked at the height of the recession, but it took multiple years for the unemployment rate to return to its pre-recessionary level.

Looking at the Global Financial Crisis in 2008, the unemployment rate hit 10% in early 2010 and it didn’t get back to 5% until five years later in 2015.

In the current crisis, the unemployment rate is expected to reach 20%, up from 14% in April. If half of those workers get their jobs back over the next three months as quarantines are lifted, it will still be the worst unemployment since 2010.

If past recessions are any guide, it will take multiple years to reach full employment again.

Company Profits Rise Faster than Employment

So what gives with the stock market? Again looking at past recessions, many large companies will see their profits grow before they start hiring. Employment gains are much slower.

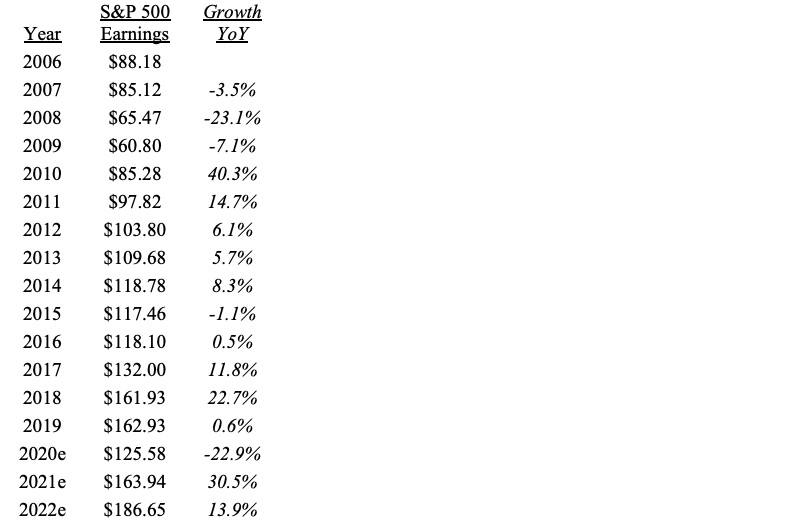

In the last recession, S&P 500 earnings peaked in 2006 and declined -30% by 2009. It took less than two years to recover and exceed it.

Source: Refinitiv, I/B/E/S data, Archer Bay Capital LLC

Will this recession follow a similar pattern?

Stock analysts are notoriously optimistic about future company earnings. We expect that the profit forecasts for 2020, 2021 and 2022 are too high and will come down somewhat. After such a severe recession, it is hard to imagine that 2021 earnings would so quickly exceed what S&P 500 companies earned in 2019.

Even if the magnitude of the earnings growth is too high, it is likely that the growth will be positive in 2021 versus this year. And with an economic recovery, workers will start to get hired again and a new business cycle begins.

At Archer Bay Capital, we help clients better understand the markets and the economy so we can make better financial decisions together. Contact us to discuss stocks, bonds, and our forecast for economic growth, or to schedule a consultation today.