Login

US GDP measures spending not wealth or earnings

Markets are driven more by the economy than by politics, but there is so much economic data released continually, how do we determine what is the most meaningful?

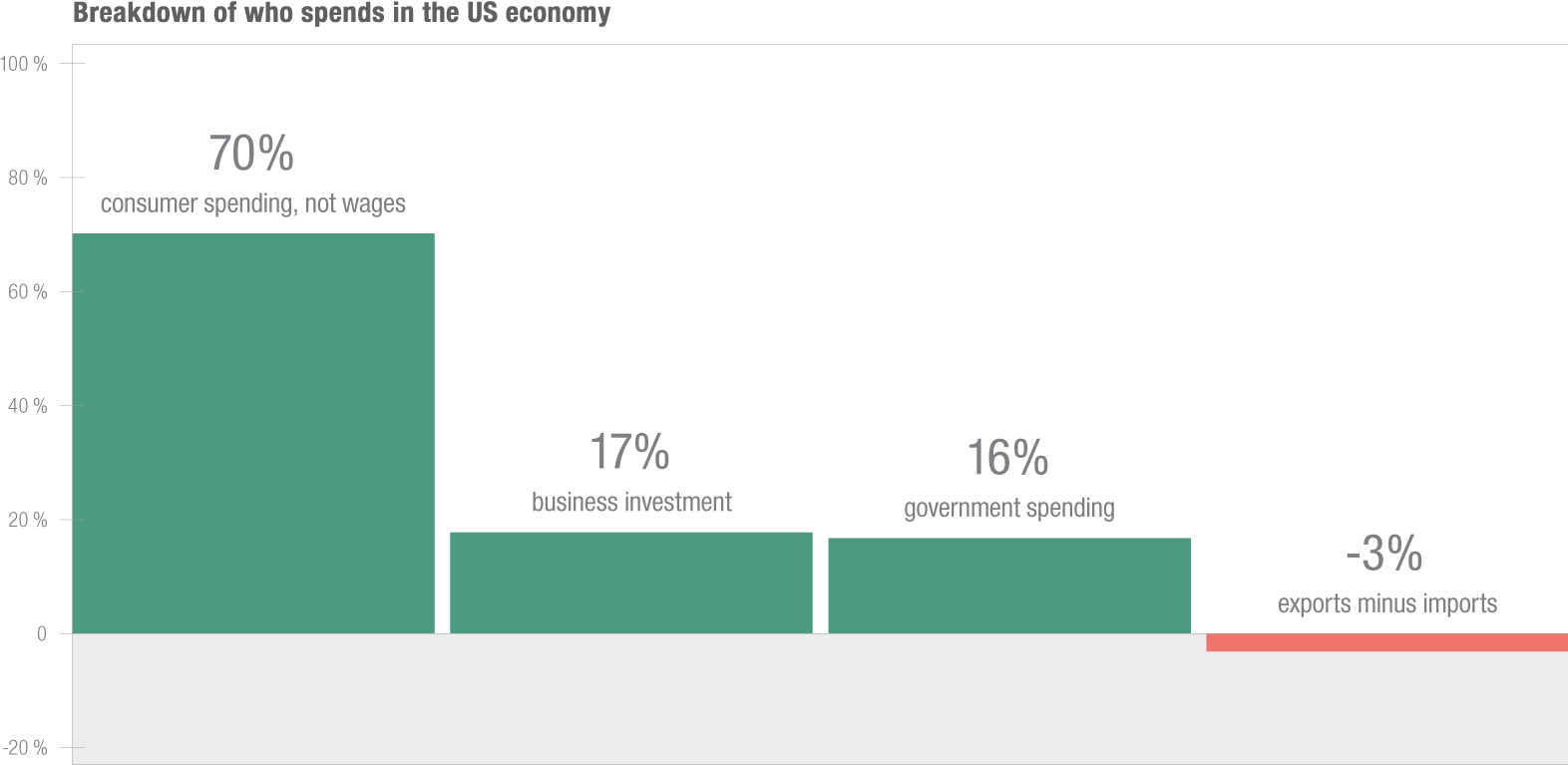

Start with the four main components of the economy, measured by the Gross Domestic Product (GDP). Conceptually, the government is trying to capture how much economic activity occurs in the country year over year. By far the biggest component of the US economy is consumer spending. It is NOT wages, but how much people spend that is included in the calculation. If you earned $100,000 but only spend $70,000, then only $70,000 is included in the economic measure. If a person earned $100,000 and spent $120,000 by running up their credit cards, it is $120,000 that is counted in consumer spending. It doesn’t matter where the money came from, what matters is how much of it is spent. Spending could come from savings, wages or debt. There is an economic incentive to keep consumers spending and not saving—it drives growth.

Similarly with business spending, only the cost to grow and expand the business is included and not the day-to-day spending that businesses need to operate.

Government spending is pretty straightforward. The military and government spending on education, healthcare, and infrastructure are included. Transfer payments like Social Security are not included because that money is already counted when the recipient spends what they receive.

Lastly, the net difference between imports and exports is included. Currently the US is running a deficit — we buy 3 percent more imports than we sell in exports. Despite the political posturing, the difference is relatively small and we are nearly in balance. The overall size is big, exports are 13 percent of our economic activity and imports are 15 percent, so trade wars and tariffs will matter if it continues to escalate.

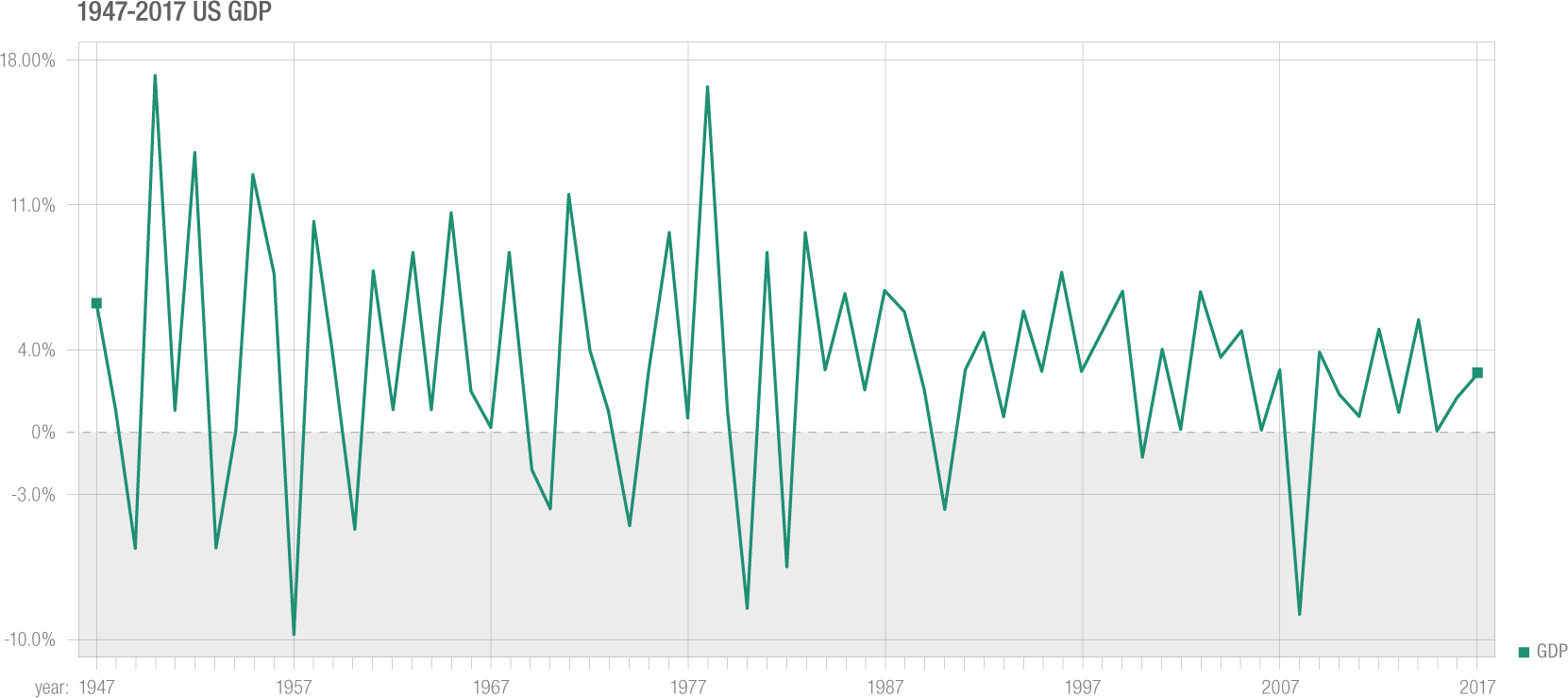

The direction of the economy matters to the financial markets but mostly in the sense of the economy growing or shrinking. How fast or slow the economy grows is not highly correlated with the financial markets performance.

The stock market is highly correlated to corporate earnings growth. The economic measure of consumer spending drives some companies’ earnings directly or indirectly, but companies make money from many sources, not only through the consumer. And many companies have large international sales, which is not included in US economic measures.

The bond market cares about inflation. If the economy grows with low inflation, the bond market is stable. If the economy slows but inflation increases, bonds will lose money.

Currently the economy has stable growth between 2-3 percent. Inflation is at 2 percent and corporate earnings growth for 2018 is 22.5 percent and for 2019 is 9.7 percent (using the S&P500 Index as a proxy).

Source: FactSet; Investopedia