What is Happening in the Stock Market?

With the recent market volatility, does it mean the stock market run is over? We examine corporate profits to look for insight going forward.

Source: FactSet, Archer Bay Capital LLC

It has been a strange year in the financial markets on many levels. Despite the recent pullback, the S&P 500 is up 23.2 percent for the year. But as we have seen in the last week, it hasn’t been a straight line up.

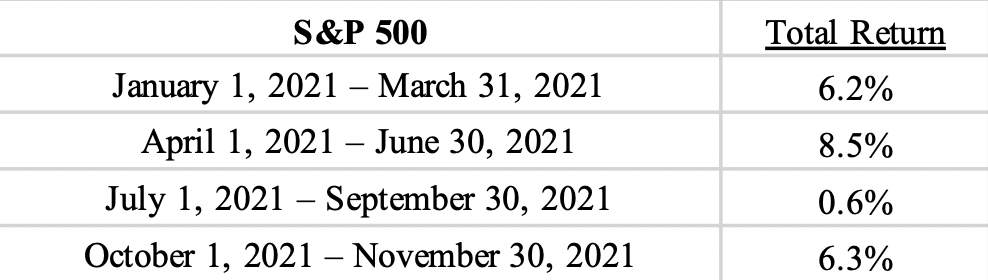

This is a year that illustrates why it is impossible to time the market. If an investor wasn’t invested the entire time, it would have been easy to miss the rallies. Here is the breakdown of returns so far this year:

Source: S&P Global, Archer Bay Capital LLC

Despite the strong return overall, it hasn’t felt very good. New variants of Covid, unusually high inflation, supply chain shortages, tight housing market, and an apparent shortage of workers are some of the biggest headlines.

With so many difficult things happening, how has the stock market increased so much this year? The answer is corporate profits. What hasn’t captured the headlines is that companies overall are making record earnings. Profit growth is the single biggest factor driving overall stock prices.

Corporate Profits Exceeding Expectations

When uncertainty is extreme, we like to dig deep into the numbers. We spend a lot of time analyzing corporate earnings (profits) in order to better understand stock market behavior. There is a high correlation over time between stock prices and earnings.

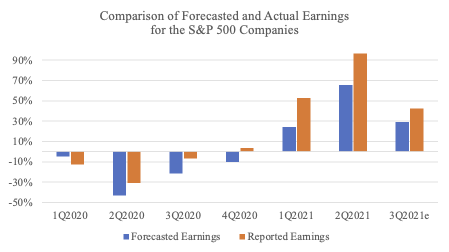

Source: Refinitiv, Archer Bay Capital LLC

The above chart shows the forecasted earnings of the S&P 500 companies prior to those companies releasing their results (forecasts are in blue). The portion highlighted in red is the amount of growth actually reported. Each quarter shows the comparison of forecasts versus actual results.

In every quarter from March 2020 through September 2021, company earnings collectively have exceeded what had been forecast. Despite all of the challenges faced by companies, they have found a way to overcome and succeed.

Even during the early days of the shutdown, in the second and third quarters of 2020, companies responded quickly to keep their businesses running and employees working. It was tough, and it still is, but the innovation and perseverance delivered during this time is impressive.

The big question is how long does it continue?

Early Outlook for 2022

Obviously, the pandemic has been a tremendous shock to the economy. To put it in perspective, the following chart shows the quarterly economic growth (GDP – Gross Domestic Product) of the US dating back to World War II.

Source: FactSet Research, Archer Bay Capital LLC

Despite all of the challenges that the US has faced in the last 70 years, nothing compares to the extreme economic drop of the Covid shutdown and then the bounce back after quarantine started to be lifted.

The justification for the tremendous amount of government stimulus was the fear that the economy recovery would be too slow and too much permanent destruction would happen. Instead, we have individual savings rate at high levels, wages are increasing, and, of course, corporate profits are reaching new highs.

Here is the corporate profit growth expected over the next year:

Source: Refinitiv, Archer Bay Capital LLC

The chart above shows the quarterly earnings growth expected for S&P 500, plus the actual earnings per share expected. For the full year 2022, overall earnings are forecasted to grow 7.9 percent over 2021.

In our view, this is not a high hurdle.

Consumers are spending, the government is spending, and companies are spending. There is inflation to manage, shortages and delays in orders, staffing challenges, and the virus is still not under control. Companies are learning how to manage through it. We expect higher profits, and stock prices, and we stay focused on the numbers.

At Archer Bay Capital, we help clients better understand the markets and the economy so we can make better financial decisions together. Contact us to discuss stocks, bonds, and our forecast for earnings growth, or to schedule a consultation today.