Year-End Wrap Up

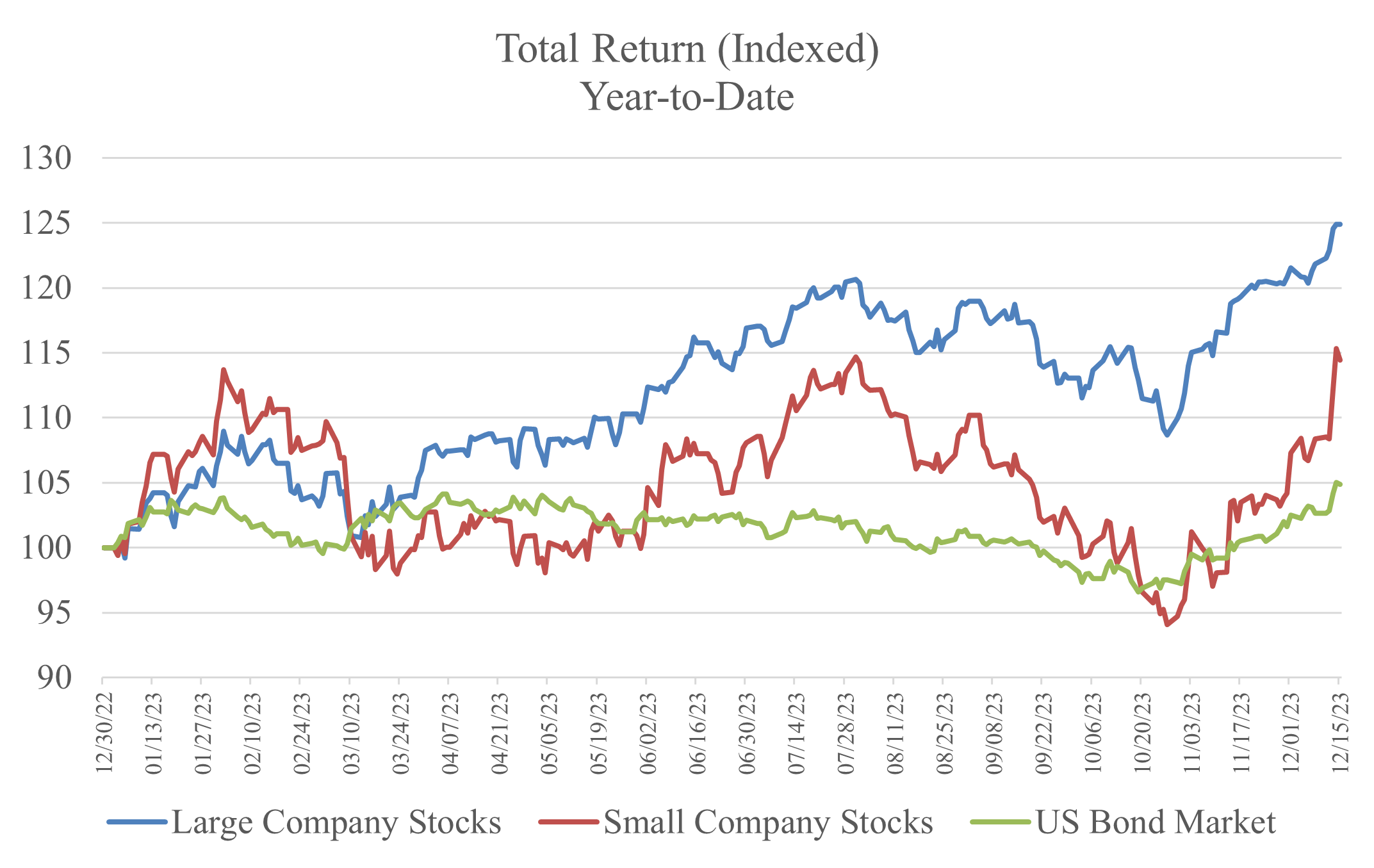

What an interesting year so far – and we still have a week to go. The chart below shows the total returns this year of large company stocks, small company stocks, and the US bond market.

Source: FactSet Research; Archer Bay Capital LLC As of 12/15/2023

Large company stocks = S&P 500, small company stocks = Russell 2000, US Bond Market = Bloomberg Bond Aggregate

Small company stocks started the year strong and then fell out of favor to a surprising degree. Recently small company stocks have been gaining ground, trying to catch up with the large company stocks since they hit a low at the end of October.

The bond market struggled to stay positive until the Federal Reserve meeting last week. Interest rate increases may be over and the market has start to anticipate when the Fed may start cutting rates. That could bring relief to indebted companies and individuals, alike.

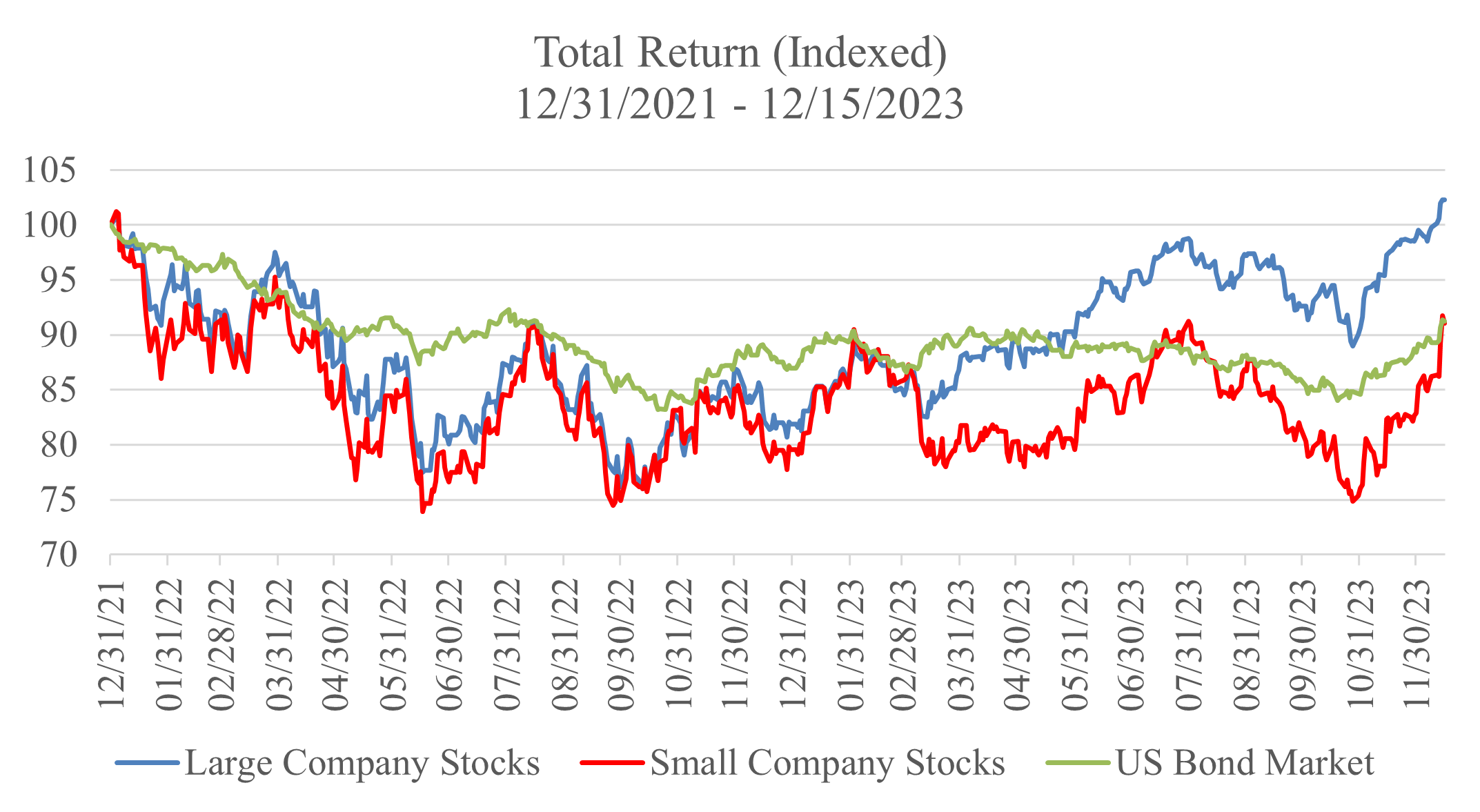

The total return of the S&P 500, which is the benchmark we use for large company stocks, has finally reached its previous peak from two years ago. In contrast, bonds and small-company stocks are both about 9% below their prior peaks. Recently, they have been catching up, but haven’t fully recovered yet.

Source: FactSet Research; Archer Bay Capital LLC

Large company stocks = S&P 500, small company stocks = Russell 2000, US Bond Market = Bloomberg Bond Aggregate

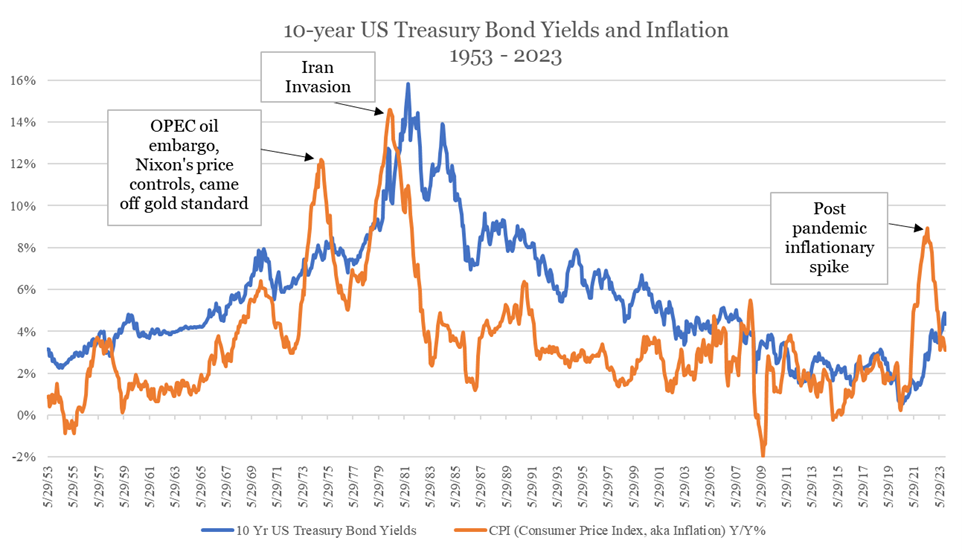

Bond Market and Interest Rates are Starting to Normalize

It is good news for the economy if the Federal Reserve has stopped raising rates. It will be even better when they start to lower rates, as long as the economy stays resilient.

The bond market hasn’t fully returned to normal yet. The good news is that inflation has fallen back below bond yields.

Source: FactSet; US Bureau of Labor Statistics; Archer Bay Capital LLC

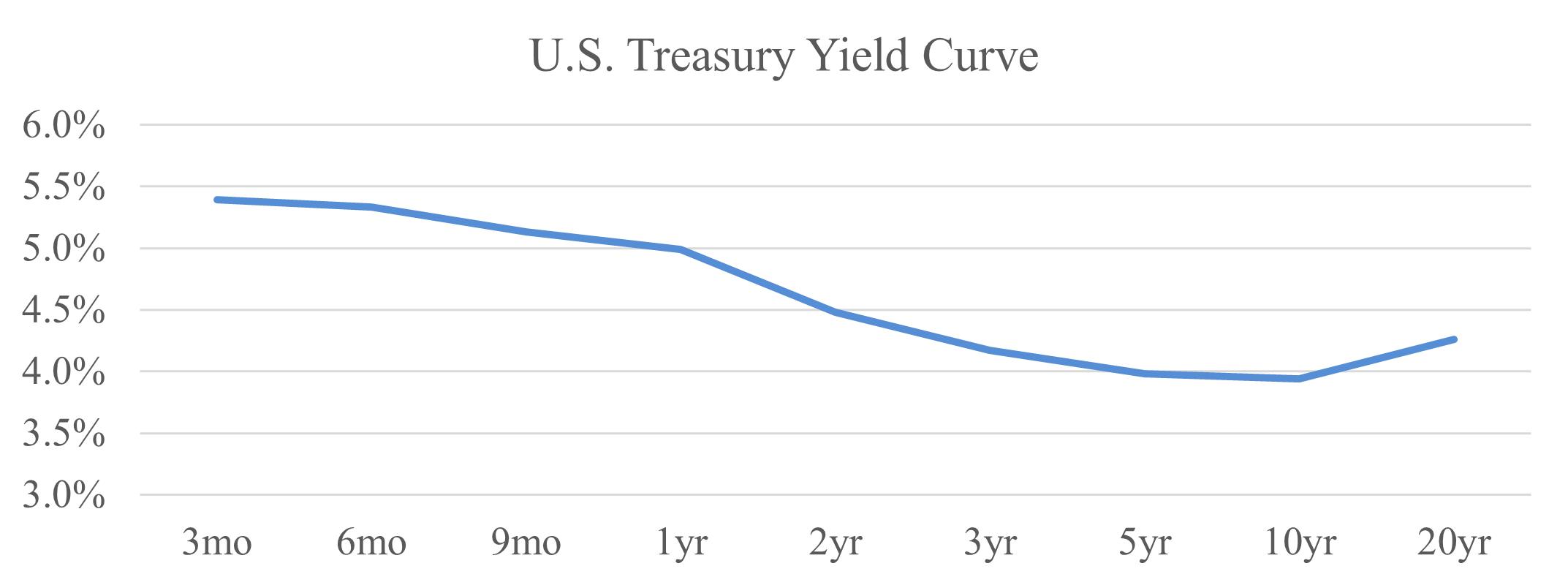

But the bad news is that the yield curve for US Treasuries is still inverted. This means that yields for bonds that mature sooner have higher yields than bonds that mature later.

Source: Fidelity Investments; Archer Bay Capital LLC

The yield for 10-year US Treasuries dropped last week to below 4%. Just two months ago, they were nearly 5%. An inverted yield curve like this has been a precursor to recessions about 75% of the time, so the economy is not out of the woods yet.

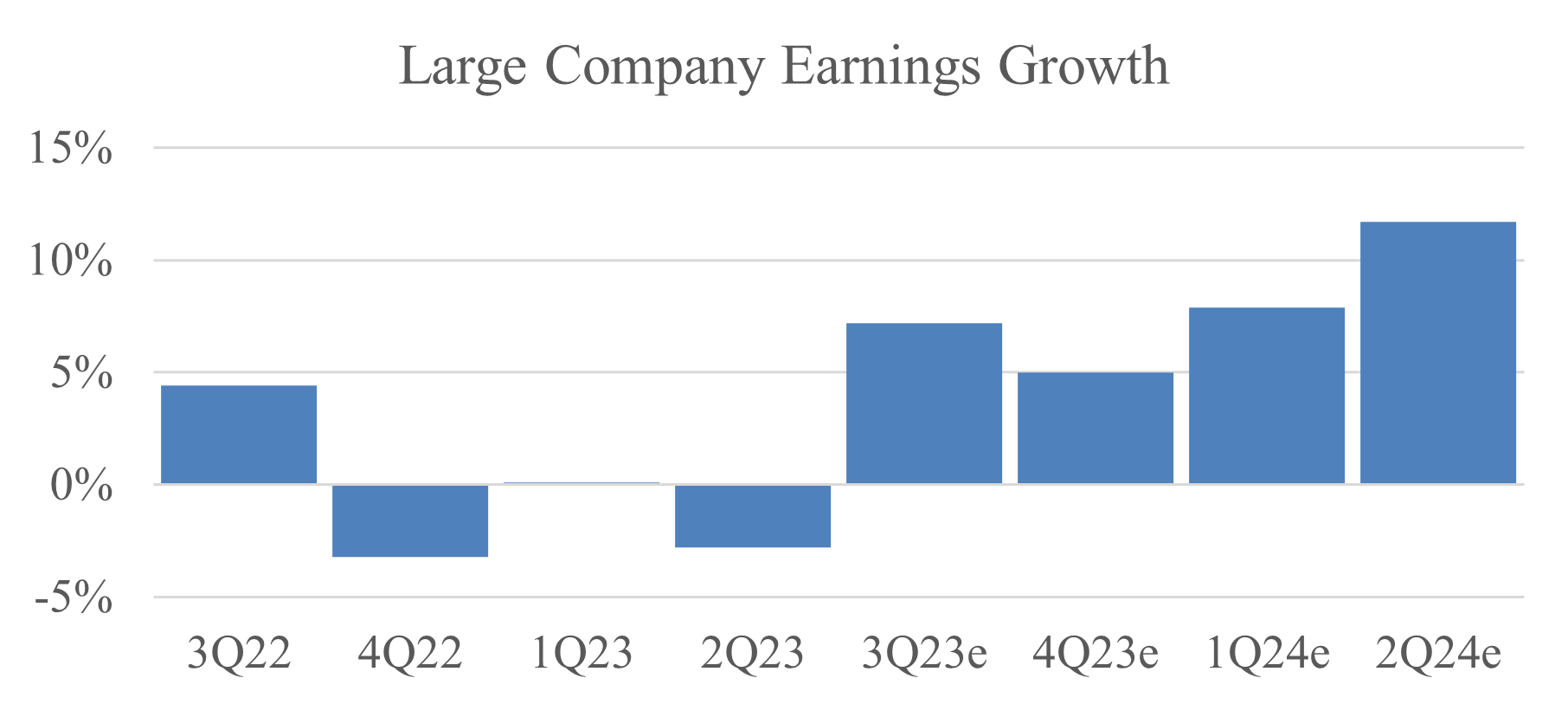

Profits are Supporting the Stock Rally

Large US companies had an earnings recession that lasted three quarters – from October 2022 through June 2023. This means that companies overall earned less money year-over-year during that time. There is some seasonality to earnings, so year-over-year comparisons tend to be more relevant than quarter-over-quarter.

Source: LSEG (formerly Refinitiv); Archer Bay Capital LLC

Large Companies = S&P 500

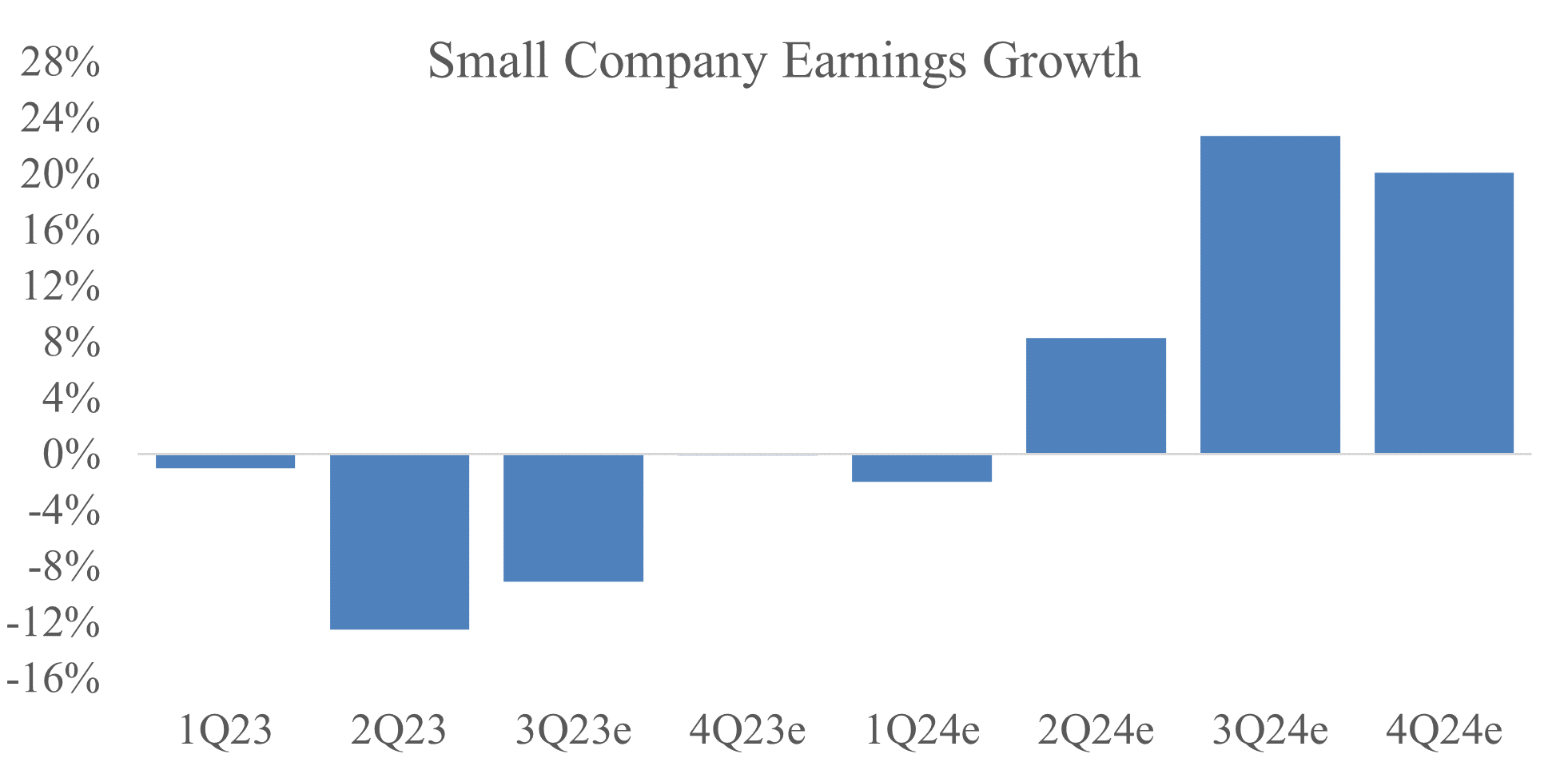

Small companies’ profits have been improving but aren’t expected to have positive growth until the second quarter of 2024. Since stock prices are about 90% correlated with earnings, this helps explain the difference in stock price performance this year.

Source: LSEG (formerly Refinitiv); Archer Bay Capital LLC

Small companies = S&P 600

Wrapping up 2023…Looking toward 2024

The markets have delivered strong returns so far this year, even though it has been a bumpy ride. If earnings continue improving as forecasted and inflation continues to decline, we believe that 2024 will also be positive for both stocks and bonds.

.