Login

Is the U.S. Economy Headed Toward a Recession in 2019?

The big question is whether or not the U.S. economy will go into recession this year. Looking back to our blog post in December, we discussed how the stock market seemed to be expecting it.

At the market trough in December, the S&P 500 was down 19 percent from the peak and the bond market was also sending negative signals. Some shorter maturity bonds were yielding higher than longer maturity bonds, which has frequently foreshadowed recessions. Now the S&P 500 has returned 13 percent for the year and is up 20 percent from the bottom on Christmas Eve.

The historical impact of slowdowns on the U.S. economy

The United States is holding up better than any other major global economy at this time but the worry is that the US will be dragged down by the slowdown in China and Europe. Since the Financial Crisis in 2008, the US economy has had two prior periods of slowing growth but it’s important to note that neither led to a recession.

The first slowdown was in 2011 when debt troubles in Europe — and the concern over the potential for Greece leaving the EU — created big uncertainty and a slow down in spending, but no great recession followed.

The second slowdown was in late 2015 and early 2016 when over-production in the oil and gas sector caused oil prices to drop so much that many energy projects became uneconomic. Bankruptcies in that industry had negative ripple effects across many parts of the economy.

Earnings for the S&P 500 actually declined in 2015 for the first time since the Financial Crisis, but recovered by the second half of 2016.

The economy didn’t go into recession then either.

Now we are seeing a third slowdown and it appears to be mostly an international problem. Global Purchasing Manager Index (PMI) surveys are pointing to evidence of recession in Asia and Europe, but not the US. The most recent report from the Institute of Supply Managers (ISM) shows evidence of US growth slowing, but it also had a couple of recent bright spots for February.

- Raw material pricing was down, which will help manufacturers;

- Inventory levels in most industries were reported as too low (Apparel was the exception), which is positive for future orders; and;

- Back-log of orders and new export orders were both up in February.

This may be evidence that the slowdown has nearly bottomed. If so, it is consistent with current corporate earnings forecasts for 2019, in which this quarter (January through March) is the weakest quarter of the year.

Source: Refinitiv, Archer Bay Capital LLC

Last month, I mentioned in the blog on the Stock Market Outlook 2019 that two events are particularly important:

1) Whether the Federal Reserve will continue to raise interest rates, and;

2) The status of the trade war with China.

Based on recent comments, it appears that the Federal Reserve will pause in raising rates. The trade uncertainty with China remains but the Chinese government has begun efforts to stimulate their own economy, which is positive. But if tariffs against Chinese goods do go into effect, we can expect another hit to growth expectations.

Are we getting any predictive signs of a recession from the bond market?

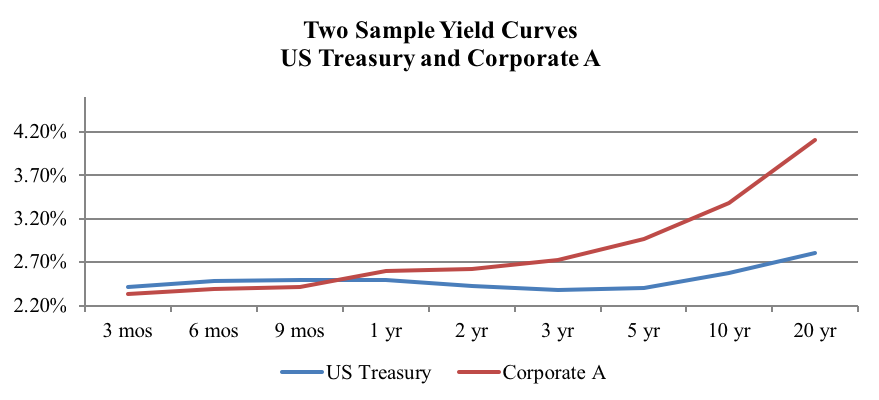

Some shorter-term maturities still are slightly higher than some medium-term maturities, but the yield curve is not inverted. In addition, the premium one expects to receive for buying a quality corporate bond over a US Treasury bond only exceeds 1 percent if you buy twenty-year maturities.

Source: Fidelity Investment Bond Trader, 3/15/2019; Archer Bay Capital LLC

What is interesting about the chart above is that it illustrates that with shorter-term maturities, you can get slightly higher rates in US Treasuries than in some high-quality corporate bonds. This is very unusual. Likely it is related to the government taking out massive amounts of debt to fund the budget deficit. It will be something to watch going forward, but it’s important to note that neither chart is predictive of a recession.

In conclusion, it does appear that economic growth is slowing, but slowing growth isn’t as damaging as a recession. Slowdowns can give companies time to make adjustments without the sudden shock of dropping demand. If 2019 is similar to what we experienced during and after the slowdowns in 2011 and 2015, it will set up companies — and earnings — for a stronger 2020.

At Archer Bay Capital, we offer personalized financial planning that enables investors to use their portfolio to support their goals. We believe that money is personal and the choice about how to manage it is entirely yours. Contact us today to learn more about our process or to set up a consultation today.

Disclosure: Investment Advisory Services offered through Integrated Advisors Network LLC (IAN) a Registered Investment Advisor. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.